A Definitive Guide: Why Your Aesthetic Clinic Should Operate As A Limited Company

We talk to Anthony Richardson from Pathway Financial Management about the pros & cons of considering incorporating your aesthetic clinic as a limited company.

Limited Companies For Aesthetic Clinics

According to Anthony: “If you're running an aesthetic clinic or considering starting one in Ireland, it’s been my experience that you're likely wondering whether to operate as a sole trader or set up a limited company. While it might seem that incorporating as a limited company may be a more complex and expensive undertaking, and that being a sole trader is the easier option, like most things in life, what takes more effort upfront often delivers better value long-term. The reality is that operating as a limited company offers aesthetic clinics significant advantages that sole trading simply can't match,”

Understanding Your Options: The Basics

Before diving into why limited companies are superior, let's quickly clarify what we're comparing here.

As a sole trader, you're operating your aesthetic business as an individual. Everything flows directly to you - the profits, the responsibilities, and yes, the risks too. You keep things simple with Form 11 tax returns to Revenue, and you can access your earnings whenever you want. All very straightforward and easy to understand.

A limited company creates a separate legal entity from you personally. You might be the sole owner and director, but the company exists independently from you in the eyes of the law.. It has its own finances, makes its own profits, and operates under different rules. This separation, as we'll see, is where all the benefits are found.

Why Limited Liability Matters More in Aesthetics

Reducing Risk For Aesthetic Clinics

Let's start with perhaps the most critical advantage: limited liability protection. In the aesthetic industry, this isn't just a nice-to-have feature - it's essential protection that could save your personal assets.

Why is this important? When you're performing treatments like dermal fillers, Botox, or laser procedures, you're taking on inherent risks. Even with proper insurance and qualifications, complications can happen. Client dissatisfaction, treatment reactions, or even frivolous claims are all possibilities.

As a sole trader, if something goes seriously wrong and you face a significant claim, everything you personally own could be at risk. Your house, your savings, your car - everything!. That's an unacceptable risk when you're trying to build a business and secure your family's future.

With a limited company, your personal assets remain separate and protected. The company might face liability, but you personally don't. This protection alone justifies the additional complexity and cost of incorporation for most aesthetic practitioners.

Important note: Incorporating as a limited liability company does not mean you don’t have to buy Malpractice insurance to protect you and your clinic from possible claims. Please find out more in our article, “Complete Guide To Insurance For Aesthetic Clinics”

According to the Companies Registration Office (www.cro.ie), over 200,000 limited companies are active in Ireland as of 2024, with healthcare and aesthetic services being among the fastest-growing sectors choosing this structure.

Tax Efficiency: Keep More of What You Earn

Things start to get really interesting from a financial perspective. Limited companies simply offer better tax efficiency than sole trading, and in an industry where profit margins matter, this can make a substantial difference to your bottom line.

Corporation tax vs. income tax rates tell the story clearly. As a sole trader in Ireland, you'll pay income tax on all your profits at rates up to 40%, plus USC (Universal Social Charge) and PRSI. Limited companies only pay corporation tax at just 12.5% on trading profits - It's one of the lowest rates in Europe.

Aesthetic practitioners can reduce their tax bills by 25-35% simply by incorporating and optimising their profit extraction strategy. Over time, that's money that can be reinvested in better equipment, additional training, or expanding your practice.

The Revenue Commissioners' guidance (www.revenue.ie/en/companies-and-charities/corporation-tax-for-companies/index.aspx) confirms that limited companies have access to various tax reliefs and allowances that aren't available to sole traders, making them the more tax-efficient choice for growing businesses.

Growth and Expansion Opportunities

You must think about the long-term future of your aesthetic business, especially in the early stages of setting up. Understanding how you will grow your business beyond just yourself is critical. A growth strategy requires you to think about hiring or partnering with other practitioners, opening multiple locations, or employing administrative staff, all of which become very limiting if you are operating as a sole trader.

With a limited company, expansion becomes much more manageable. You can issue shares to new partners, hire employees more easily, and create clear organisational structures.

Research from the Irish Small and Medium Enterprises Association (www.isme.ie) shows that practices operating as limited companies are significantly more likely to successfully scale beyond a single practitioner.

If you're ambitious about growing your aesthetic practice - and frankly, why wouldn't you be in such a thriving industry - starting as a limited company sets you up for success from day one.

Better Financial Management and Planning

One aspect that often surprises new aesthetic practitioners is how much easier financial management becomes with a limited company. Yes, there are more rules and requirements, but there's also much better separation and clarity.

With sole trading, your personal and business finances get mixed together, which can become messy quickly. You need to be incredibly careful about tracking business expenses, separating personal and business use of assets, and managing cash flow.

A limited company forces better financial discipline. You have separate bank accounts, clearer expense tracking, and more sophisticated financial planning options. This might seem like additional complexity initially, but it makes life easier as your practice grows.

The Institute of Chartered Accountants Ireland (www.charteredaccountants.ie) reports that businesses operating as limited companies have significantly better financial record-keeping and planning, leading to improved profitability and growth rates.

Comprehensive Pension and Retirement Benefits

According to Anthony, “in my view, the retirement planning and other financial benefits available to directors of limited companies are dramatically superior to those for sole traders. Often, these benefits of incorporation are completely underestimated by many aesthetic clinic owners. We're talking about potentially the difference of hundreds of thousands of euros in additional retirement savings over your career”.

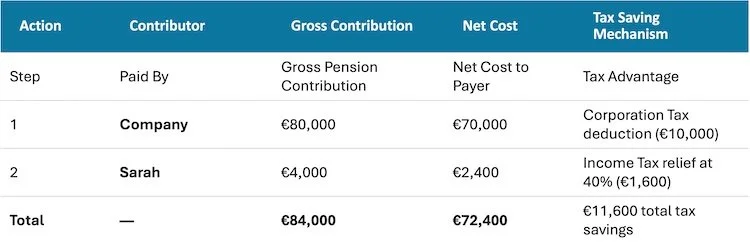

The Optimal Pension Strategy for Company Directors: A Two-Step Approach

For a company director, the most powerful pension strategy involves leveraging both corporate and personal contributions in the correct order to maximise tax efficiency. The goal is to first use the highly efficient company contribution method, and then, if desired, top up with a personal contribution.

Let’s break down the two steps with a detailed example.

Our Example Director:

Name: Sarah

Age: 52

Salary from her company: €80,000

Age-Related Pension Limit: 30% of earnings (as she is between 50 and 54)

Her Total Annual Allowance: 30% of €80,000 = €24,000

Step 1 — Maximise Employer PRSA Contribution

Rule (as of 1 January 2025):

An employer can contribute up to a maximum of one times the employee's salary to an employee’s PRSA, without age-related or salary-based limits.

Example contribution:

Sarah’s company decides to contribute €80,000 to her PRSA — equal to 100% of her salary.

The company pays €80,000 directly into Sarah’s PRSA.

Treats this as a deductible expense, reducing taxable profit.

Corporation Tax saving at 12.5% = €10,000.

Net cost to the company = €70,000.

Sarah pays no income tax, USC, or PRSI on this amount.

Result: The full €80,000 lands in Sarah’s pension in Year 1 — a huge uplift compared to the old 25% limit.

Step 2 — Top-Up with Personal Contribution (Optional)

Sarah’s personal tax relief limit for this year is:

Age-related limit = €24,000 (from €80,000 × 30%)

Employer contribution count: Employer PRSA contributions do not reduce her maximum personal tax-relief calculation in the PRSA world. (This is another major change vs. occupational pensions.)

That means Sarah could still personally contribute up to €24,000 and get tax relief — but whether that makes sense depends on her cash flow and long-term plan.

Let’s say she decides to contribute €4,000 personally:

She pays from after-tax income.

As a higher-rate taxpayer (40%), she claims a tax refund of €1,600 (40% × €4,000).

Net cost = €2,400, but her pension grows by €4,000 gross.

Summary: The Power of the Combined Strategy

Key Takeaways

Employer PRSA contributions can effectively double the salary they are taking by paying 100% of salary into their PRSA pension— perfect for directors who want to extract value from the company tax-efficiently.

No Benefit-in-Kind → avoids income tax, USC, PRSI.

Corporate tax deductible → lowers the company’s corporation tax bill.

Personal top-ups still get income tax relief within age-related limits.

Key takeaway: For directors, always max out the company route first and then decide if a personal contribution makes sense. The employer can contribute far more than before, up to 100% of salary in a single year

*Benefit in kind (BIK) -A benefit in kind (BIK) is any non-cash benefit of monetary value that you provide for your employee. These benefits can also be referred to as notional pay, fringe benefits or perks. The benefits have monetary value, so they must be treated as taxable income. See revenue.ie

The Result If Sarah Operates as a Sole Trader

Maximum Contribution for Tax Relief:

Personal contributions are capped at the lower of:€115,000 earnings cap (no impact here), and

Age-related percentage of net relevant earnings — for Sarah: 30% × €80,000 = €24,000.

No Employer Contribution Option:

All contributions must come from post-tax income — there is no company structure to make large employer payments.Tax Treatment:

She contributes €24,000 from her own funds.

As a higher-rate taxpayer, she claims €9,600 in income tax relief (40%).

Net cost = €14,400.

Total in pension: €24,000 in a single year — less than one-third of what she could fund as a company director with the PRSA strategy.

Make up for lost time with a “Special Contribution”

According to Anthony, “For company directors, it’s never too late to supercharge your pension. If previous years’ pension funding has been slow or neglected, you have options to catch up — but the rules differ depending on the type of pension you use.”

With an Executive Pension Scheme (still used by many company directors alongside or instead of a PRSA), Revenue allows the use of “Special Contributions” — large, one-off lump sums designed to make up for underfunding in prior years. These can factor in all worked service where pension contributions were not made with the company when calculating the allowable amount.

With a PRSA (post-2023 rules), there’s no need to “carry forward” unused allowances because employer contributions are no longer capped by salary or age-related limits. Your company can contribute up to 100% of your salary.

The most tax-efficient route: Have your company make the payment. It’s fully deductible against corporation tax at 12.5% and isn’t treated as a benefit-in-kind — meaning the entire contribution enters your pension free from income tax, USC, or PRSI.

Bottom line: Whether through an Executive Pension with Special Contributions or a PRSA lump sum, directors can reclaim lost ground quickly — transforming years of underfunding into a significant retirement boost in a single move.

Executive Pension Schemes

Limited companies can establish executive pension schemes, which offer even more flexibility. These can include:

Death in service benefits of up to four times the annual salary

Ill-health early retirement provisions

Flexible contribution patterns to maximise tax efficiency

The company pays the premiums, gets corporation tax relief at 12.5%, and you receive no personal tax charge. It's essentially a tax-free benefit that builds your retirement wealth.

Small Self-Administered Schemes (SSAS)

For established aesthetic practices, an SSAS offers incredible flexibility. Your company can contribute to the scheme, which can then:

SSAS can purchase commercial property (including from the member or connected parties, provided it is done on arm’s-length terms and fair value) and invest in a wide range of assets. It cannot invest in residential property directly if there’s any connected party use — this is subject to heavy tax penalties. Worth clarifying to avoid misleading readers.

Invest in a diversified portfolio of assets

Tax-Efficient Exit Strategies: Building Generational Wealth

One of the most compelling reasons to incorporate is the range of tax-efficient exit strategies available when you eventually sell or transfer your aesthetic business. These options can literally save you hundreds of thousands in tax, money that stays in your family rather than going to Revenue.

Capital Gains Tax Relief (CGT Relief)

Under Irish tax law, when you dispose of shares in a qualifying company, you may be eligible for CGT Relief which reduces the capital gains tax rate from 33% to just 10% on gains up to €1 million over your lifetime.

For this relief to apply, your company must be:

A qualifying company (which aesthetic practices typically are)

Held for at least 3 years

Used wholly or mainly for trading purposes

Let's say you build your aesthetic practice over 20 years and sell it for €2 million, having originally invested €200,000. Your gain would be €1.8 million. With CGT relief, you'd pay just 10% on the first €1 million (€100,000) and 33% on the remaining €800,000 (€264,000) - total tax of €364,000.

As a sole trader, you'd pay 33% on the entire gain (€594,000), costing you an extra €230,000. That's a quarter of a million euros that stays in your pocket just by having the right business structure.

Retirement Relief

Even more generous is Retirement Relief, which can eliminate capital gains tax entirely on qualifying disposals. If you're over 55 and dispose of qualifying business assets that you've owned for at least 10 years, you could pay zero capital gains tax on gains up to €750,000, with the 10% rate applying to the next €250,000.

This relief is available to company shareholders but has much more restrictive conditions for sole traders.

Family Succession Planning

Limited companies make it much easier to gradually transfer your business to the next generation in a tax-efficient manner. You can:

Gift shares annually using the €3,000 annual gift exemption

Use the €400,000 lifetime gift threshold between parents and children

Implement succession planning strategies that minimise inheritance tax

The Revenue Guide to Capital Gains Tax (Employing Your Children: A Tax-Efficient Education Strategy www.revenue.ie/en/gains-gifts-and-inheritance/capital-gains-tax/index.aspx) provides detailed information on these reliefs, but the key point is that they're designed to reward entrepreneurship and business-building, and they work much better with incorporated structures.

Here's a strategy that many aesthetic practitioners don't realise is available: employing your children in your limited company can be an incredibly tax-efficient way to fund their education and give them a financial head start in life.

The Basic Strategy

Your limited company can employ your children (once they're old enough to work - typically 16 or over) in legitimate roles within the business. This could include:

Social media management and content creation

Reception and administrative duties

Basic bookkeeping and filing

Cleaning and maintenance tasks

Helping with marketing materials

The keyword here is legitimate - Revenue will scrutinise these arrangements, so the work must be real, and the payment must be reasonable for the tasks performed.

Tax Benefits for Everyone

When structured correctly, everyone wins:

Your Company:

Pays the salary as a business expense

Reduces corporation tax liability at 12.5%

Gets legitimate help with business operations

Your Child:

Earns their own money tax-efficiently

Builds work experience and business understanding

Can fund their own education and expenses

You Personally:

Effectively transfer money to your child without gift tax implications

Reduce your overall family tax burden

Maintain control through the company structure

An Example Of The Numbers

Let's say you employ your 17-year-old to manage your clinic's social media and general admin for 10 hours per week at €12 per hour. That's €6,240 per year.

Your company saves €780 in corporation tax (12.5% of €6,240). Your child pays no income tax (below the €18,000 threshold) and minimal PRSI. You've effectively transferred €6,240 to your child while saving tax - and they've earned it legitimately.

Scale this up appropriately (always keeping payments reasonable for work done), and you could fund significant education expenses very tax-efficiently.

University and Education Funding

This strategy becomes particularly powerful for funding university education. Instead of paying university fees from your taxed income, your children can use their earned income. The psychological benefit is significant too - they're funding their own education through work, not receiving handouts.

Important Compliance Points

Revenue's guidance on employing family members (www.revenue.ie/en/employing-people/employee-or-self-employed/index.aspx) is clear that:

Work must be actually performed

Payment must be reasonable for the work done

Proper employment procedures must be followed

PAYE, PRSI, and USC must be operated correctly

The employment must pass the "arm's length" test - would you pay someone else the same amount for the same work?

Building Financial Literacy

Beyond the tax benefits, employing your children in your aesthetic business teaches valuable lessons about:

Work ethic and responsibility

Business operations and customer service

Financial management and tax obligations

The value of money and entrepreneurship

Many successful business families use this strategy not just for tax efficiency, but to prepare the next generation for business ownership and financial responsibility.

What are the Downsides of incorporating a company?

While incorporation brings tax and pension benefits, there are additional costs - incorporation fees (currently €100 with the CRO (www.cro.ie), annual filing requirements, and the need for accurate bookkeeping, which typically leads to higher accountancy fees. In short, there are more rules to follow and more administration.

The Companies Registration Office filing requirements mean annual returns (Form B1) and audited accounts for larger companies, which can seem daunting initially. You'll also have less flexibility in accessing company funds - you can't just dip into business money as easily as with sole trading.

But here's the thing: these aren't really downsides, they're just different ways of operating. And frankly, they encourage better business practices that will serve you well as your practice grows.

Making the Decision: When to Incorporate

So, when should an aesthetic practitioner incorporate? The honest answer is: probably from the start, or as soon as you're generating consistent income from treatments.

If you're just dipping your toes in the water with occasional treatments, sole trading might suffice temporarily. But if you're serious about building an aesthetic practice - and most practitioners are - the benefits of incorporation far outweigh the additional complexity.

The Central Statistics Office (www.cso.ie) data shows that health and beauty services have grown significantly in Ireland over the past five years, with limited companies leading this growth.

Getting Professional Help

One thing I can't stress enough: get proper professional advice. While the case for incorporation is strong, your specific circumstances might affect the timing or structure that works best for you.

A good accountant familiar with the aesthetic industry and Irish tax law can help you understand the implications, set up appropriate structures, and ensure you're maximising the benefits while staying compliant with all requirements. The strategies around pension planning, exit strategies, and employing family members all require careful implementation to ensure compliance with Revenue requirements.

The Bottom Line

If you're running an aesthetic clinic in Ireland and you're still operating as a sole trader, it's probably time to seriously consider incorporation. The liability protection alone justifies the change, but when you add in the 12.5% corporation tax rate, superior pension benefits, tax-efficient exit strategies, and opportunities for family wealth planning, it becomes an overwhelming case.

The aesthetic industry is booming in Ireland, and practitioners who position themselves professionally and financially for growth are the ones who'll thrive. The question isn't really whether you should incorporate - it's whether you can afford not to, especially when the tax benefits alone could fund your entire retirement and your children's education.

Looking for more guidance on starting your aesthetic business, reach out to Anthony Richardson, Director & Financial Planner,QFA RPA SIA BBS - Pathway Financial Management.

Anthony Richardson,

Director & Financial Planner,

QFA RPA SIA BBS,

Pathway Financial Management.

+353 (0)1 584 0140

info@pathwayfinman.ie

About, Pathway Financial Management is a Dublin-based firm founded by Paul and Anthony, offering over 20 years of combined experience. They provide personalised financial guidance tailored to individuals, families, and small businesses, including those with complex employment histories.

Their expertise encompasses estate planning, retirement planning, income protection, and wealth management, all explained in clear and simple terms. In addition to one-on-one advice, they are also experienced in delivering financial wellness education to groups, helping clients achieve confidence and security on their unique financial journey.